Content

Despite the advantages of the accrual-based system, particularly in terms of measuring the costs of public activities, the absence of a profit motive justifies the need to maintain, at least in part, the “old system” (i. e. cash-based). Therefore, a dual-system option appears suitable, namely in the European Union accounting and financial reporting system (Biondi & Soverchia, 2014). Therefore, “tax accounting” and financial accounting have different motivations and cannot be unified (Molín & Jirásková, 2015).

However, the court considered this correction poorly justified, since the TA assumed the acceptance of the depreciation when recorded in the related party balance sheet, but not in that of the taxpayer’s. Additionally, the expense met the general deductibility requirements established in article 23 of the CITC, with the taxpayer being the only harmed party, as it was prevented from deducting the annual depreciation of the asset. In this case, an inconsistency arose from the TA wrongly interpreting https://accountingcoaching.online/ and arguing for the deduction of the depreciation in one company while refusing it in the other.

The methodology states that the expenses are matched with the revenues in the period in which they are incurred and not when the cash exchanges hands. TransactionsA business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.).

The procedure through which sample observations are generalized in order to reach a broad conclusion. With these limitations identified, they provided some guidelines to improve empirical legal research, increasing its credibility and validity. Another problem emerges when the TA refuses to apply a symmetric correction to the reported income. In practice, TA’s amendments leading to additional tax in a certain period are not combined with the corresponding rectification in favour of the taxpayer in other period. By ignoring an actual expense, the taxpayer will be taxed for an income which was never obtained, leading to the violation of the ability-to-pay principle. For example, if the expense was wrongly deducted in fiscal year N, because is related to N-1, the increase in taxable income in fiscal year N should be compensated by the reduction in the tax income for N-1. Such a procedure aims to determine the real income in each of the two periods .

However, the commissions are not due to be paid until May, so you will need to accrue the $4,050 for the month of April since the expense is clearly tied to the sales revenue that was earned in April. Depreciation expense reduces income for each period that the expense is recorded. In addition, this theory recognizes that target debt ratio varies from different organisation . However, the application of the shield tax applies to companies that are safe, with tangible assets, taxable income to shield must to have a peak target ratio. Hence, variances are analysed by shaping how much differences have impacted the revenue and profits . This specific aspect is essential for accounting managers of easyJet that takes the correct strategic direction, which is required to prevail over the issues before to cut the profits too much. Another aspect is activity based costing as it has modelling system that is found in manufacturing firms.

Reporting With Cash Basis Accounting And Accrual Basis Accounting

The matching principle is one of the ten accounting principles included in Generally Accepted Accounting Principles , stating that businesses are required to match income to related expenses in a specific period of time. Cash flow statements aim to present the cash flow effects of transactions that occur during an accounting period and are therefore not based on the accruals principle. Accruals basis of accounting ensures that expenses are “matched” with the revenue earned in an accounting period. Expenses, on the other hand, must be recorded in the accounting period in which they are incurred. Therefore, accrued expense must be recognized in the accounting period in which it occurs rather than in the following period in which it will be paid. When – voluntary or involuntary – reporting of income occurs in the wrong period, thus violating the accrual principle, conflicts arise between the TA and taxpayers and litigation may follow. Frequently, the dispute between TA and taxpayers concerning this matter is caused by the corrections to the taxable income, as a result of tax auditing, leading to additional tax charges.

- Expenses, on the other hand, must be recorded in the accounting period in which they are incurred.

- Matching is a reliable form of measuring operating performance to support informed decisions by the stakeholders and is consistent with accrual-based accounting.

- The core of all considerations is the discussion about whether all revenues reported in accounting are income that is subject to tax.

- In such cases revenue from sales is recorded when sales actually happen and now when cash is received 30 or 60 days later.

- The differences between accrual and cash accounting also have significant tax implications.

- The accrual definition may also vary based on industry and business model.

Another client stayed on a cash basis because they have seasonal activity. They didn’t want to make the accounting harder for the periods when they aren’t making as much money. As a smaller, seasonal business, with peaks and valleys, cash basis accounting works well for them.

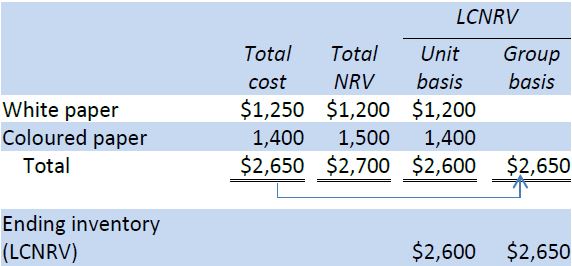

How To Calculate An Inventory Balance Using Fifo

The statement of retained earnings, which is the second report created, tells how much, if any, of the money that a company makes in an accounting The accrual principle period is retained and reinvested in the company. When a company sells its product to a customer, it must record the transaction.

If a symmetric correction does not occur, the taxpayer is doubly affected, as it loses the deduction of an expense in the incorrect period and in the correct one. As a result, if it is no longer possible for the taxpayer to amend this situation, due to legal expiration dates, the TA, according to Campos, Rodrigues, and Sousa , should not proceed with the correction at all. To the best of our knowledge, this is the first paper focusing on the interpretations issued by different Portuguese courts concerning the application of the accrual principle established in the Corporate Income Tax Code. Similarly, the payment of an amount owed to a vendor does not affect equity. An airline sells its tickets days or even weeks before the flight is made, but it does not record the receipts as revenue because the flight, the event on which the revenue is based has not occurred yet. When utilities or rent are billed after the period to which they apply, the company accrues the expense during the period that it uses the utilities or rented property.

- It showcases exactly what is happening in the business, not what a business will achieve shortly.

- It is employed by most companies (except small-cap companies that employ cash basis accounting methods) in order to prepare financial statements.

- As a smaller, seasonal business, with peaks and valleys, cash basis accounting works well for them.

- The statement of retained earnings, which is the second report created, tells how much, if any, of the money that a company makes in an accounting period is retained and reinvested in the company.

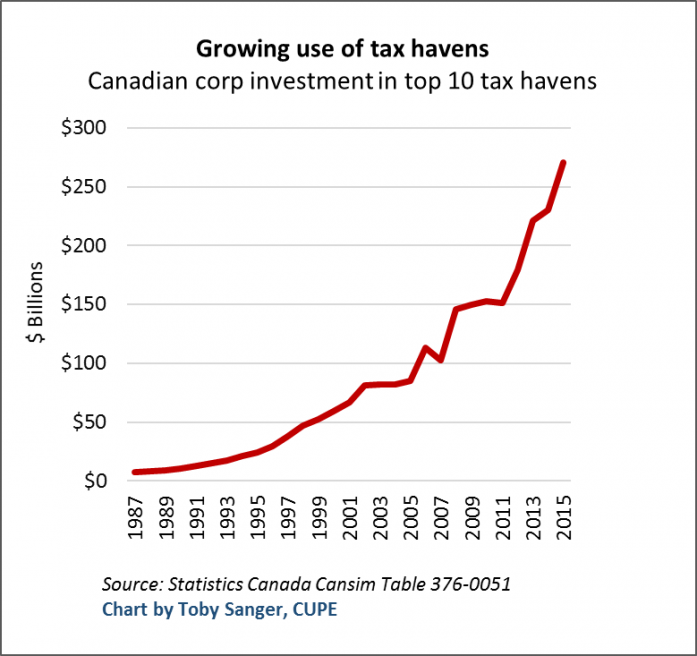

Moreover, the purpose of the tax system is to collect revenues, in addition to other economic and social roles, such as resource allocation, redistribution of income and economic stabilisation. Sheffrin emphasises that the intended role of taxation is to serve as a mechanism to correct market outcomes, introducing in the community principles of justice, fairness or desert . However, Sheffrin found that often political preferences introduced into tax law were not consistent to a merit-based society. Since the accrual principle is common to the fields of accounting and tax law, legal research is done in both areas with the purpose of capturing its real nature and implications. Therefore, addressing the research question formulated above has the potential for contributing towards an improved coherent framework for the application of the accrual principle in the field of taxation.

Cash Basis Or Accrual Basis Accounting: What’s Better?

From the twenty-four decisions selected, eleven were decided in favour of the taxpayer, ten in favour of the TA, while three can be characterised as mixed decisions. These generated about €30,6 million worth of corrections performed by the TA that were annulled by the court, while corrections of €17,9 million were accepted. The main purpose of this section is to understand the various interpretations of the application of the accrual principle by the courts throughout recent years. This analysis includes the arguments put forward by both the TA and the taxpayers; the resulting court ruling and, when applicable, an opinion about that final ruling.

- This paper analyses the relation between accounting and taxes in the Czech Republic using a specific example of the accrual principle.

- We help businesses run with total confidence backed by financial and management reporting they can depend on.

- This method allows the current cash inflows or outflows to be combined with future expected cash inflows or outflows to give a more accurate picture of a company’s current financial position.

- As a result, if the company uses the cash accounting method, the $5,000 in revenue would be recorded on Nov. 25, which is when the company receives the payment.

- The recognition of revenue and expenses is not concerned with the dates of actual cash flows.

Like the payroll accrual, this entry will need to be reversed in May, when the actual commission expense is paid. For the month of April, your company had sales in the amount of $27,000. This means that you owe your sales staff a total of $4,050 in commissions for the month of April.

If there is a loan, the expense may include any fees and interest charges as part of the loan term. This disbursement continues even if the business spends the entire $20 million upfront. It may last for ten or more years, so businesses can distribute the expense over ten years instead of a single year. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Now, if we apply the matching principle discussed earlier to this scenario, the expense must be matched with the revenue generated by the PP&E. Expenses not directly tied to revenue production should be expensed immediately in the current period.

Accrual Accounting Concept In Ifrs And Gaap

The accrual principle requires that transactions be recorded in the period that they occur in regardless of when the actual cash is exchanged. This means that a company will book expenses even if the cash has not been paid out yet, and it will book revenue even if the cash has not been received yet. The purpose of this is to reflect a company’s performance more accurately over a period of time. Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold or expenses are recorded as incurred before the company has paid for them. Deciding between cash basis or accrual basis accounting really depends on the state of your business. For reporting purposes, accrual basis will usually provide better financial intelligence on the true state of your business.

Principles are settled in law and are developed in legal writing performed by researchers. In previous sections, doctrinal research has been shown to frame the existing law in this specific topic. In the next section, from the analysis of judicial decisions of courts it can be seen how law is applied, offering insights into unresolved aspects of the law. This is useful to provide recommendations on how to interpret and employ the law, overcoming the flaws that currently affect it.

The accrual accounting system is very flexible and provides the management many opportunities to manipulate their financial statements. However, other accounting principles reduce such flexibility and the ability of management to cook the books. So, if a business earns money in 2013, it will be recorded as sales for 2013, even if the payments for this sale are expected to be received only in 2014. The goal of the financial statements is to provide financial data that is so accurate and concise that it can paint a vivid picture of how well a company is performing at a specific point in time. Together, these two important concepts can reach the goal set by the financial statements.

Why Is The Principle Called accrual?

There are also modified versions of the cash method of accounting that allow for the limited use of accruals. Medium to large businesses, whose sales exceed 5 million on average over a three-year period, are required to do accrual basis accounting. Since the IRS requires most nonprofit organizations to file a 990 information return, accrual basis accounting is preferable because it allows for GAAP compliance. However, most nonprofits struggle with monitoring their cash, so they might look at cash basis reports or cash projections on a monthly basis. For example, as you saw above, Chris measured the performance of her landscaping business for the month of August using cash flows.

Similar to many other countries, in Portugal, corporate income is taxable (Portuguese corporate income tax code – CITC). Accounting plays an important role in corporate taxation, since accounting profit is the basis for determining taxable income. However, accounting principles are not the sole set of rules used for establishing taxable income, since adjustments (i. e. including and/or excluding some entries) are performed by complying with the CITC. From this process a tax base is obtained, reflecting the application of both accounting rules and the tax code. This solution is consistent with article 104 § 2 of the Portuguese Constitution, which states that real income is the basis of corporate taxation. This constitutional demand realises the ability-to-pay and equality principles . In effect, the use of accounting is important towards quantifying real income but does not have a monopolistic role .

So by not recording 5,000 as receivables users will not have any idea how many cash is to be received by the entity in the future. If we wait for cash, then recording might be so delayed that it is either recorded in a different period or the time until we record the transaction it will have no relevance in that period for economic decisions. The main question relates to the acceptance of this negative income variation in 2012. The court understood that the correct procedure was to report it in 2011 under the article 18 of the CITC. Additionally, in 2011, due to the tax losses registered, the deduction of this amount would be less effective than in 2012, when the company obtained taxable income.

Accrual basis accounting is the form of accounting that records revenue when it is earned and expenses when they are incurred regardless of when cash is received or paid out. Now notice the part of the definition that says ‘regardless of when cash is received or paid out.’ That’s a very important part of this whole idea. The revenue recognition principle states that revenue is recognized, or reported, when it is earned regardless of how cash flows. Cash basis accounting tends to be used by small businesses and organizations that pay taxes via their owner personal tax returns. Under the cash basis method, revenue and expenses are recorded based solely on cash flow.

In this case, the court ruled that an unjustifiable violation of accounting procedures took place, mentioning specifically the accrual principle and the principle of prudence. Under these circumstances, it concluded that the principle of justice should not prevail.

The Effects Of Revenue Recognition On Financial Statements

The revenue generated by the consulting services will only be recognized under the cash method when the company receives payment. As a result, if the company uses the cash accounting method, the $5,000 in revenue would be recorded on Nov. 25, which is when the company receives the payment. Accrual accounting creates a more accurate picture of profit or loss, so the salon’s owner can have a better understanding of its profitability from period to period. If the salon is small and the profits and costs are easily understood, it might not be worth the extra effort to the owner to use accrual-basis accounting. If the salon is seeking ways to better understand profits and costs, accrual-basis accounting would be a great choice. Requires businesses to report using accrual-basis information when preparing tax returns. In addition, companies with inventory must use accrual-based accounting for income tax purposes, though there are exceptions to the general rule.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

At the end of each reporting period, companies pass adjusting journal entries to record any accruals, for example accrual of utilities expense, interest expense, accrual of wages and salaries, adjustment of prepayments, etc. Assume your small business paid $50 last quarter to buy products that you sold in the current quarter. Under the matching principle, you would recognize the $50 cost of the products as an expense in the current quarter because that is when the sale occurred. This matches the expense of the products to the same period as the revenue the products generated. The timing of when you paid for the products does not affect when you record the expense. In addition, any companies with more than $25 million in revenue or that are publicly traded must use accrual accounting.